Chart of the Week and Weekly Report Highlights

This week: Growth Scare, China Macro, EM vs DM, EMFX, EM Fixed Income, Equity Sentiment, global equities, second wave for commodities

This email provides a look at what we covered in the latest Weekly Insights report

The weekly insights report presents some of the key findings from our institutional research service, providing an entrée experience (in terms of price and size).

Chart of the Week - Mortgage Servicing Costs

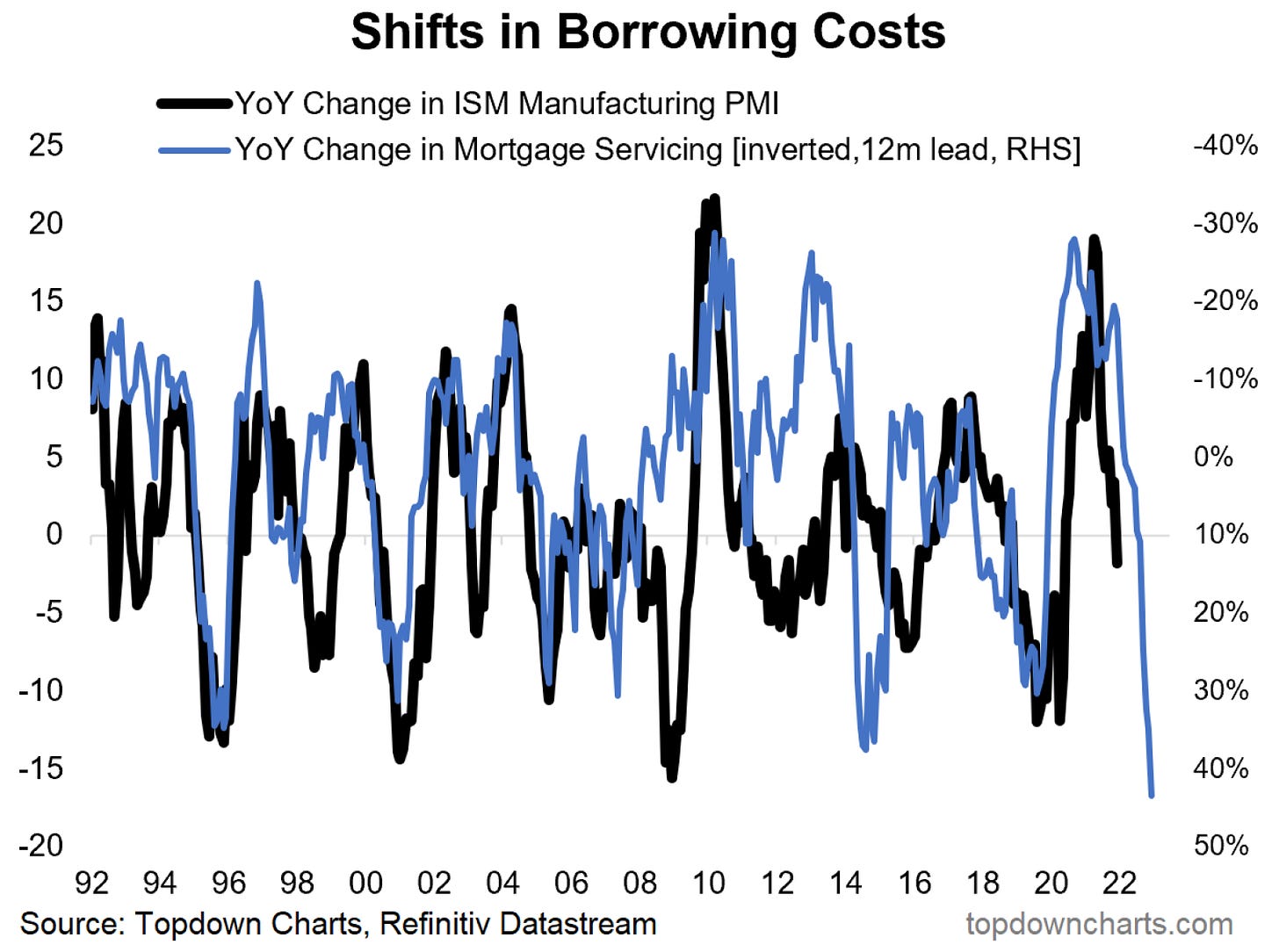

Higher Borrowing Costs for Mortgages: One consequence of the Fed policy pivot is higher bond yields in turn creating higher borrowing costs. The chart below shows just how far US borrowing costs have shifted in recent months (n.b. the change in borrowing costs is shown inverted to align with the direction of the PMI).

The FHA effective mortgage rate ticked up to 3.77% vs the lows of 2.98% early last year. Taking that into consideration along with the rising cost of homes, the indicative mortgage servicing cost indicator has increased by 45% for the USA. That is a very significant rise, and will likely weigh on consumer confidence.

EDIT 20 May 2022: mortgage rates are now over 5.5% and the mortgage servicing cost indicator has gone up now more than 130% off the low point (!!). [UPDATED CHART]

Rising bond yields will also lead to a lower equity risk premium over time, reducing the relative value and attractiveness of stocks vs bonds. But honing in on the chart below, we likely see downward pressure on the PMI — which reinforces our 2022 growth scare scenario thesis… and as previously noted, the global economy already seems to be losing momentum. The macro backdrop is steadily shifting!

Key point: Indicative mortgage servicing costs have gone up 45% in the USA.

If you haven’t already, be sure to subscribe to our paid service so that you can receive the full reports ongoing (along with access to the archives, monthly asset allocation review, and Q&A).

Topics covered in the latest Weekly Insights Report:

Growth Scare: a global growth scare is a credible risk this year

China Macro: we detail why the PBOC is pivoting to stimulus

EM vs DM: some reasons to be bullish after a bashing in 2021

EMFX: an overview of the outlook in 2022

EM Fixed Income: change in recommendation for EM Bonds

Equity Sentiment: review of sentiment and tactical outlook

Commodities: status check on the second wave of price rises

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn